ny highway use tax return instructions

USDOT NYS Tax ID Password. Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final totals in boxes 1a and 1b below Schedule 1 total tax Schedule 2 total tax Total highway use.

Highway use tax - Schedule 1 Do not report Thruway mileage or vehicles required to be included in.

. New York State Department of Taxation and Finance. 90300101220094 Department of Taxation and Finance. 122 Legal name Mailing address Number and street or PO Box City State ZIP code.

USDOT - Enter your USDOT Number. If you have any questions please see Need help. At wwwtaxnygov or call 518 457-5431.

Claim for highway use tax hut refund. Instructions for Form MT-903 Highway Use Tax Return mt903i Keywords InstructionsForm MT-903HighwayUse TaxHighway Use Tax. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor.

Highway Use Tax HUT Web File is the easiest and fastest way to file a highway use tax return and make a payment. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you. Use Form 2290 to.

Highway Use Tax Web File You can only access this application through your Online Services account. Form MT-903 is filed monthly annually or quarterly based on the amount of the previous full calendar year s total highway use tax liability Monthly - more than 4 000 Annually - 250 or less with Tax Department approval Quarterly - all others including carriers not subject to tax in the preceding calendar year You may request a change of filing status based on your previous year. 18 rows Highway usefuel use tax IFTA Form number Instructions Form title.

New York State Department of Taxation and Finance Instructions for Form MT-903 Highway Use Tax Return MT-903-I 199 Who Must File You must file Form MT-903Highway Use Tax Return if you have been issued a highway use tax permit or you operate a motor vehicle as defined in Article 21 of the Tax Law in New York State. Miles traveled in New York State for this period by all vehicles. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55000 pounds or more.

The highway use tax HUT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. Instructions for Form MT-903. Do not report mileage traveled on the toll-paid portion of the New York State Thruway or mileage traveled by buses or other.

Youll receive an electronic confirmation number with the date and time you filed your return. If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. Ny may request a copy of your cp575 this is the document that the irs issues when your company is assigned an fein number once you have an active nyhut account it is your responsibility to file the quarterly tax returns same deadlines as ifta.

Instructions for form 2290 heavy highway vehicle use tax return 0719 06152020 inst 2290. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due. By clicking Log In you agree to the Terms and Conditions and certify all information you submit to us is true and correct to the best of your knowledge.

The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway by a tax rate. The tax rate is based on the weight of the motor vehicle. Ad Download Or Email MT-903-MN More Fillable Forms Try for Free Now.

If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due. You can also file now and schedule your electronic payment for a date no later. Do not report mileage traveled on the tollpaid portion of the New York State.

Form MT-903 Highway Use Tax Return Revised 122. 1Highway use tax schedule totalsFirst complete Schedule 1 or Schedule 2 or both on back and then enter finaltotals on lines 1a and 1b below Schedule 1 total tax Schedule 2 total tax Total highway use tax add 1a and 1b 1a 1b 1c 2Prior highway use tax overpaymentsto be applied attach a copy of Form MT-927. NYS Tax ID - Enter your FEIN federal employer identification number including the suffix numbers or SS if applicable.

A credit for overpayment as shown on Form MT-927 Highway Use Tax HUT Overpayment Adjustment Notice a duplicate payment made for a certificate of registration or an overpayment shown on your amended Form MT-903 Highway Use Tax Return. To compute the tax due on the schedules below see the Tax rate tables for highway use tax on page 4 of Form MT-903-I Instructions for Form MT-903. 199 Who Must File You must file Form MT-903Highway Use Tax Return if you have been issued a highway use tax permit or you operate a motor vehicle as defined in Article 21 of the Tax Law in New York State.

Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period. Highway Use Tax Return. Miles including New York State Thruway miles traveled in New York State for this period by all vehicles.

Do not report mileage traveled on the toll-paid portion of the New York State Thruway or mileage traveled by. Be sure to use the proper tables for your reporting method. Highway Use Tax ReturnMT-903.

For more information see TB-HU-260 Filing Requirements for Highway Use Tax. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due. New York State highway use tax TMT New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

Final return Amended return Mark an Xin the applicable box. Figure and pay the tax due if during the. Use Form DTF-406 to request a refund of the highway use tax for.

New York Hut Report My Fuel Tax

Ny Hut Permits J J Keller Permit Service

Notary Public Address Change Notary Public Notary Public

The 4 Key Processes Enabled By A Transport Management System Tms Transportation System Logistics

Notary Public Address Change Notary Public Notary Public

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

New York Hut Report My Fuel Tax

Entry Level Engineering Resume Must Be Written Excellently Using Powerful Words And Easy To Understand For Accountant Resume Engineering Resume Resume Examples

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Janitorial Services Sample Proposal Janitorial Services Janitorial Cleaning Services Janitorial

Ny Highway Use Tax Hut Explained Youtube

Highway Use Tax Web File Demonstration Youtube

Best Truck Driving Jobs Images On Pinterest Driving Truck Driving Jobs Trucks Truck Driver Jobs

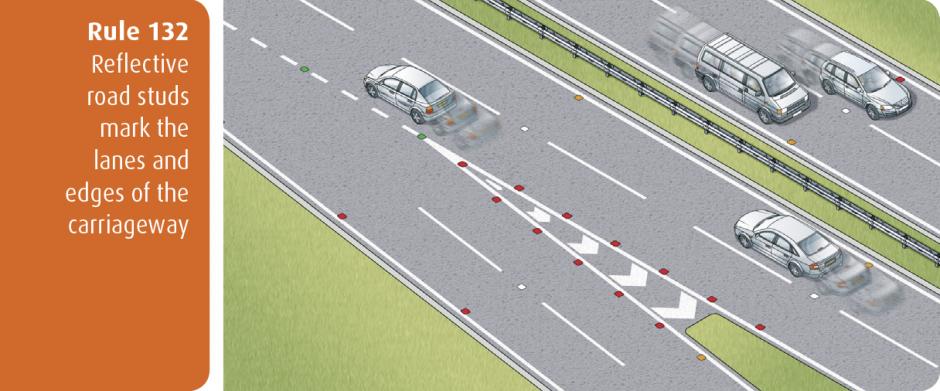

Rules And Advice For Drivers And Riders 103 To 158 Nidirect

Our Bravest Collection Is All About The American Firefighting Tradition Found In Cities Across The Usa While Cr Red Fire Fire Service Promote Small Business

New Gravel Springs Road Interchange On I 85 Set To Open Tuesday News Gwinnettdailypost Com

New Highway Code Rules What You Need To Know Rac Drive